Cleveland, home to Quadax headquarters, is also home to some of the finest medical facilities in the world. (Many of them, we’re proud to say, are Quadax clients.) At the same time, out of 88 counties in Ohio, Cuyahoga County (the greater Cleveland area) ranks 62nd for health outcomes[i]. Overall life expectancy is 1.6 years below the national average. Infant mortality is well above the national rate, with significant racial disparity. In terms of health factors contributing to outcomes, Cuyahoga County ranks 86th in Ohio for Physical Environment, and 81st for Social & Economic Factors, which include children in poverty, income inequality, unemployment, and violent crime.

In response to this dichotomy, Dr. Akram Boutros, M.D., FACHE, President and CEO of The MetroHealth System said, “It’s time to stop applauding medical care that’s administered after the fact, no matter how good it is, and start providing health care before people get sick.”[ii]

The MetroHealth System is doing just that, as announced in their recently-issued 2018 Annual Report, with the new Institute for Health, Opportunity, Partnership and Empowerment (H.O.P.E.)—just one of the programs they’ve created to identify and act on social determinants of health.

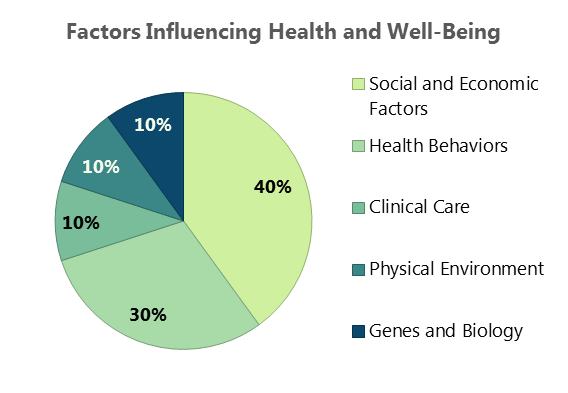

The Centers for Disease Control defines Social Determinants of Health (SDoH) as the conditions in the places where people live, learn, work, and play affecting a wide range of health risks and outcomes.[iii] “Right now in the United States of America in the year 2019, your zip code is more predictive of your health outcomes than your genetic code,” says Kate Walsh, President and CEO of the Boston Medical Center Health System. Commonly cited research reveals the contribution of clinical care to an individual’s health to be only about 10%, while socio-economic conditions, health behaviors, and physical environment combine to contribute 80% to a person’s health status.

Figure 1. Source: Minnesota Department of Health

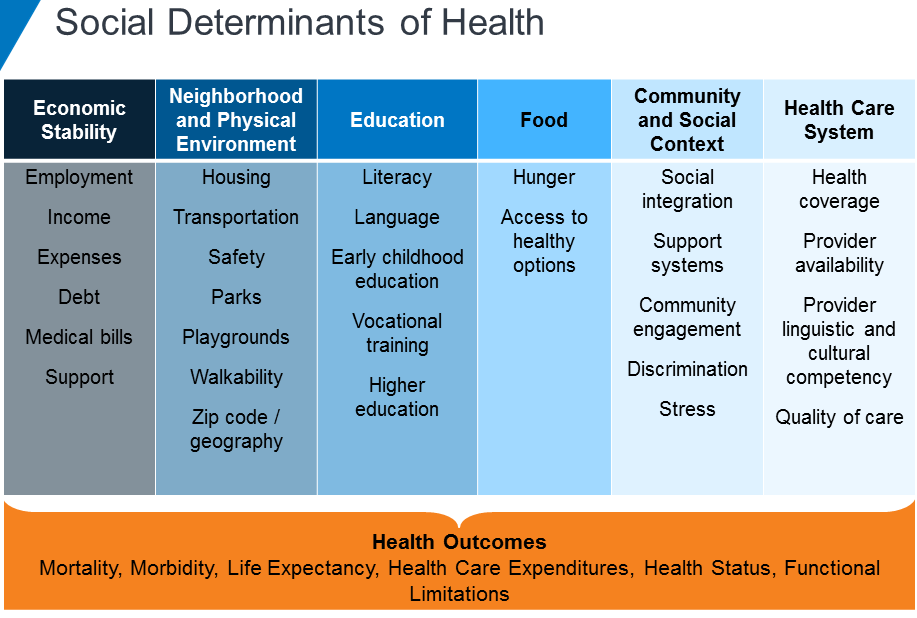

Lists of SDoH vary in number of categories, based on the arrangement of contributing factors, depending on the source. The CDC identifies five key areas; this table (below) from the Kaiser Family Foundation arranges the factors into six categories:

Figure 2. Source: Kaiser Family Foundation

The relationship between social conditions and health has been recognized for many years. Now, as our health care system shifts further toward value-based care, ever greater attention is being given to these socio-economic factors which will either support or undermine medical intervention.

AARP has found social isolation among older adults is associated with an additional $6.7 billion in Medicare spending annually. In people of all ages, factors such as social support, food security, economic stability, and physical safety will dictate their adherence to plans of care, making appointments, and avoiding hospital readmissions.

In a reimbursement environment focused on outcomes, providers will see greater success when patients’ health is established and maintained over the long term, enabling them to consume fewer acute care resources.

It’s a Community Thing

Dr. Boutros has stated, “Poor health doesn’t just affect the sick; it impacts entire communities.”He also observed, “The chronic stress of poverty has been demonstrated to hinder the development of executive function and to create dysregulation of emotion and attention. These lifelong effects are some of the underlying reasons why children living in poverty may not excel in school, choose risky behavior and have more suicide attempts.”

To that end, MetroHealth has developed programs to address Physical Environment, Health Behavior, and Socio-economic Factors in order to improve physical and mental health and reduce health care costs. The Institute for H.O.P.E will become a hub to provide access to resources and programs for education, employment, food, transportation, and housing. A grocery store, food pantry, classrooms, legal aid services, and financial literacy training are just some of the features planned. MetroHealth has also announced plans for new apartments, programs for employee assistance, and telemedicine service for college students in four states. These programs add to a long list of initiatives designed to transform the community, including the Open Table model.

A little less than two hours to the west of The MetroHealth System, ProMedica is likewise committed to caring for their community: the greater Toledo area, stretching into southeastern Michigan. In 2015, partnering with the AARP Foundation, ProMedica announced the formation of The Root Cause Coalition, a 501(c)(3) nonprofit organization to address hunger and other social determinants of health. In the same year, it opened its first food pharmacy, distributing food to patients with a physician referral. Since then, two additional Food Clinics have begun operation, and overall the Food Clinics have served more than 6,600 distinct households with “food as medicine.”

Recognizing many in ProMedica’s community live in food deserts, ProMedica has also invested in Market on the Green and a Mobile Market to bring fresh, local produce and fresh meat, dairy, and more at affordable prices to families and individuals who otherwise would never see fresh, healthful food in their neighborhoods.

According to Randy Oostra, President and CEO of ProMedica, “The healthcare industry must not only deliver clinical excellence and efficiency, we must hone in on how we can act as catalysts, innovators and leaders to improve the health of our entire communities.” Oostra has also observed that there is a business case for addressing social determinants of health in terms of lowering health care costs, reducing absenteeism, and increasing productivity.

Getting There from Here

In 2017, the Deloitte Center for Health Solutions conducted a survey of about 300 hospitals and health systems about health-related social needs investments. According to their findings, “80 percent of hospital respondents reported that leadership is committed to establishing and developing processes to systematically address social needs as part of clinical care.” However, current activity is often fragmented and ad hoc. There are gaps in screening, and finding sustainable funding is a challenge. Those hospitals making the greatest progress toward value-based care models, such as accountable care organizations (ACOs), are reporting the highest level of activity in the area of addressing social determinants of health.

Research into the association between social services coordination by health systems and a reduction in health care expenditures has to date been limited, but preliminary studies do show a positive correlation. A study conducted by WellCare Health Plans and the University of South Florida College of Public Health found a 10% reduction in health care costs for people who were successfully connected to social services for needs such as housing services and utility assistance.

Effective analysis of the return on investment for addressing social determinants of health requires hospitals employ data analytics to track meaningful measures—and to be patient as results are more likely to be seen over the long-term. Collecting data, selecting meaningful metrics, and understanding which components are providing the greatest ROI will depend on collaboration between clinical areas, social service partners, and revenue cycle representation.

While the data and analysis may take years to capture and understand, the data presently available on the connection between SDoH and health outcomes is clear and compelling.

As Dr. Boutros has pointed out, we have known for twenty years that increased Adverse Childhood Experiences lead to increased likelihood of diabetes, obesity, depression, sexually-transmitted disease, or suicide attempts. We also know, just as low-income Americans suffer higher rates of heart disease, diabetes, stroke, and other chronic conditions, poor health statuses also contribute to lower income, creating a cycle that’s hard to break.

Moving interventions upstream presents numerous challenges, but as characterized by Dr. Boutros, it’s a moral imperative.

Quadax applauds the efforts of The MetroHealth System and ProMedica in going beyond symptoms to tackle root causes and enhance the overall health of these Ohio communities.

In future articles, we’ll examine other SDoH initiatives as well as practical steps for moving forward with such efforts.

[i] https://www.countyhealthrankings.org/app/ohio/2019/rankings/cuyahoga/county/outcomes/overall/snapshot

[ii] Dr. Akram Boutros, “What Hospitals are Getting Wrong and How We Can Fix It,” delivered at The City Club of Cleveland, June 7, 2019. https://www.cityclub.org/forums/2019/06/07/what-hospitals-are-getting-wrong-and-how-we-can-fix-it Transcript here.

[iii] https://www.cdc.gov/socialdeterminants/index.htm

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.