The nation’s largest health insurers are responding to the coronavirus pandemic with changes to coverage associated with COVID-19 as the number of cases continues to swell across the country.

The biggest payers have said they will waive patient cost-sharing — copays, coinsurance and deductibles — for testing. Although some, such as Cigna and Humana, have gone further by eliminating cost-sharing for all COVID-19 treatment.

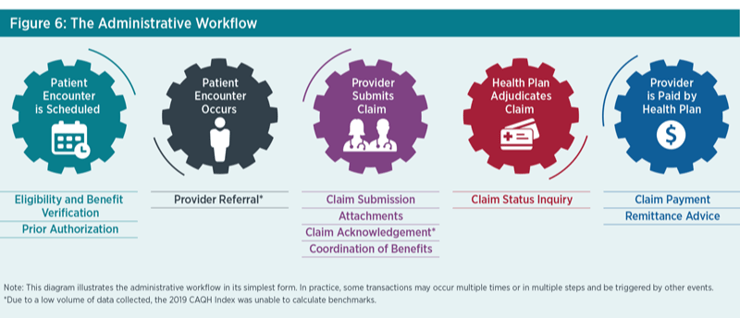

In addition to coverage decisions, insurers are weighing the ways they can reduce administrative barriers to promote quicker access to care for those infected with the Novel Coronavirus. All are cutting back on prior authorization in various ways to ease access to care.

Hospitals say that’s not enough, and are calling on the biggest payers to follow actions taken by Congress and Centers for Medicare & Medicaid Services (CMS) to help resolve cash flow issues, by accelerating payments or opting into releasing interim periodic payments. The American Hospital Association (AHA) is also urging payers to eliminate administrative burdens such as prior authorizations.

“This crisis is challenging for all of us, and everyone has a role to play,” AHA said in its letter to the nation’s largest insurers. “You could make a significant difference in whether a hospital or health system keeps their doors open during this critical time.”

Despite the policy changes by payers, employers with self-funded plans can opt out of these policies. A majority of workers are covered by self-insured plans, which essentially allow employers to decide coverage decisions given they’re paying for the claims and having insurers simply perform administrative services.

Here are updates from top insurers:

Aetna (CVS)

UPDATED 4/2/2020

Aetna will waive cost-sharing for certain members admitted to an in-network hospital with COVID-19 or complications from the disease. The policy applies to all of Aetna’s commercial plans, though self-insured members can opt out. The policy will apply to admissions through June 1, 2020. Aetna also is waiving cost-sharing for testing and associated visits, including telehealth.

Aetna is attempting to make access to hospitalization faster for those with COVID-19 by easing prior authorization requirements, particularly in areas hard hit by the outbreak like New York and Washington.

Anthem

UPDATED 4/2/2020

The nation’s second largest commercial insurer will waive cost-sharing for COVID-19 treatment and will reimburse providers at either in-network or Medicare rates through May 31, 2020. The policy applies to Anthem’s fully insured, individual, Medicaid and Medicare Advantage members. Self-insured plans can opt out. Anthem also is waiving cost-sharing for COVID-19 testing and in-network visits associated with testing whether it’s conducted at a physician’s office, urgent care or ER.

Anthem is easing its limits on early refills for 30-day prescriptions. Anthem said it would waive cost sharing for telehealth visits, including those for mental health for a period of 90 days starting March 17, 2020. Self-insured plans have the option to opt in the new virtual care policy.

Blue Cross Blue Shield Association

UPDATED 4/2/2020

The BCBSA is eliminating cost-sharing for COVID-19 diagnostic testing.

BCBSA will remove prior authorization requirements for testing and for services that are medically necessary to treat an infected patient. BCBSA also is waiving limits on early refills to make it easier to access medications and expanding access to telehealth services.

Centene

UPDATED 4/2/2020

Centene will waive cost-sharing for COVID-19 related screening, testing and treatment for its Medicaid, Medicare, and Marketplace members through June 30, 2020.

Centene also will eliminate prior authorization requirements for care for all its Medicare, Medicaid, and Marketplace members. The company is working to supply federally qualified health centers with personal protective equipment and assistance in providing small business loans to behavioral health providers and long-term service support organizations.

Cigna

UPDATED 4/2/2020

Cigna will waive cost-sharing for all COVID-19 treatment, including testing and telehealth screenings through May 31, 2020. The policy applies to Cigna’s fully-insured group plans, individual coverage and Medicare Advantage plans. Self-insured plans can opt out.

Cigna will reimburse providers either at in-network or Medicare rates depending on the member. Cigna is also easing access to maintenance medication by offering free shipping for a 90-day supply and easing prior authorization requirements for patients being discharged from the hospital to post-acute stays.

Humana

UPDATED 4/2/2020

Humana is waiving cost-sharing for testing and treatment, including hospital admissions for COVID-19 cases. The policy applies to its Medicare Advantage plans, fully-insured commercial plans, Medicare supplement and its Medicaid plans. The policy is indefinite with no current end date. Cost-sharing will be waived for all telehealth visits and members can opt to refill prescriptions early.

Humana also is easing administrative barriers to allow infected patients to easily move from a hospital to post-acute care setting. It’s suspending prior authorization, referral requirements and requesting notification within 24 hours. It’s also implementing an expedited claims process to reimburse providers faster.

UnitedHealthcare

UPDATED 4/2/2020

The nation’s largest commercial insurer, will waive cost-sharing for COVID-19 testing at approved locations in accordance with Centers for Disease Control guidelines. The insurer will also waive cost-sharing for visits related to testing including at physician offices, urgent care, ERs, and telehealth visits. The policy applies to United’s commercial, Medicare Advantage, and Medicaid members.

UnitedHealthcare is opening a special enrollment period for some of its commercial members who opted out of coverage during the traditional enrollment period with their employers. This enrollment period will end April 6, 2020. The insurer also is easing prior authorization requirements through May 31, 2020, suspending prior approval for post-acute care and switching to a new provider.

*This blog post is taken from a Healthcare Dive news article.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.