If you think managing the healthcare revenue cycle is challenging now, brace yourself because there are several forces that are likely to drive more complication and complexity into the revenue cycle. Recent analyses of hospital finances are painting a complex picture – Medicare spending cuts, declining service volumes, rising costs, a shrinking payer mix, underutilized technology and increasing financial waste are all threatening the profitability of our hospitals and providers.

We’re Getting Older

As more and more baby boomers reach the age of 65, the mix of profit-generating commercial business and break-even to unprofitable government payers will continue to shrink. In addition to the increasing Medicare population, reductions in federal payments to hospitals will total $252.6 billion from 2010 to 2019, according to a new report commissioned by the American Hospital Association and the Federation of American Hospitals.

To compound the issue of an aging population and cuts in federal reimbursement, a report from Fitch Ratings predicts the third straight year of declining profitability for the nonprofit hospital sector, but not as steep as the previous two years. Finally some good news!

No More Passing the Buck

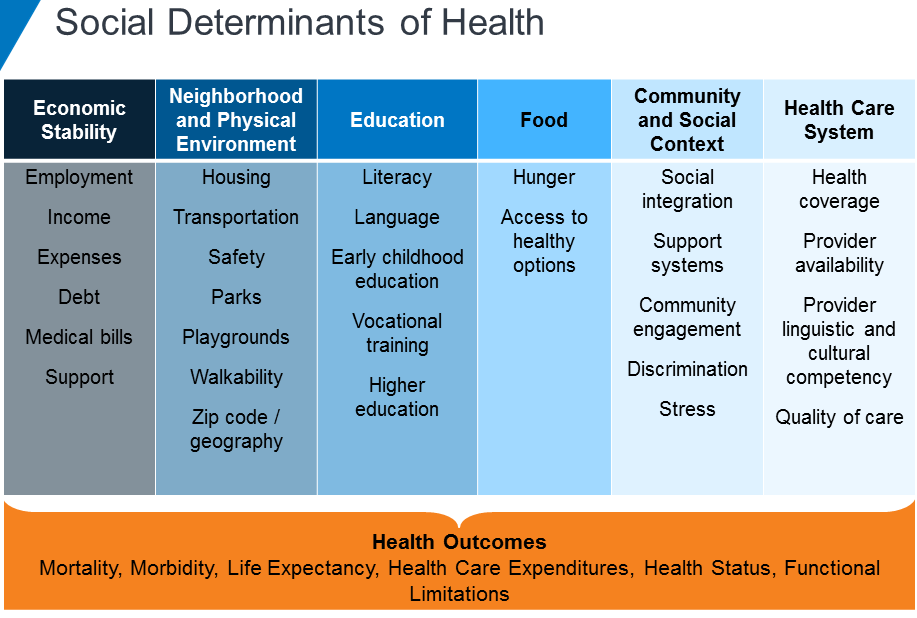

As the nation transitions from fee-for-service reimbursement to value-based care, coordinated efforts amongst an array of providers are required to improve quality and efficiency of patient care – and reimbursement. Under this approach, providers are financially rewarded for positive patient outcomes and efficient care delivery. This is a major shift in behavior from the traditional fee-for-service model, where providers are compensated for each test, treatment, and medication, regardless of patient impact.

While the goal of value-based reimbursement is expected to improve our population’s health, the shift in approaches brings along a new set of challenges for the healthcare industry. While many organizations are hiring care management coordinators and behavioral health support staff members to build the necessary infrastructure for value-based care, many are still citing the following as barriers to adopting this standard of care:

- Lack of staff time to collaborate between providers

- Unpredictability of revenue

- Lack of ability to understand potential financial risk

- Lack of resources to report, validate and use data

Regardless of these challenges, with only 39.1% of healthcare payments made in 2018 under a fee-for-service structure and the increased industry demand for value-based care, profitable provider organizations need to partner with each other and insurers to deliver value rather than passing the buck back and forth.

A Lot of Money is Wasted

Imagine throwing 25% of your paycheck right out the window. That is how much of healthcare spend in the United States is wasted. Administrative complexity is responsible for the most waste ($265.6 billion) – billing and coding errors and time spent reporting on quality measures. The authors of the report cited opportunities to reduce administrative waste through insurer-clinician collaboration and data interoperability.

The United States spends almost twice as much as other high-income countries on medical care despite similar utilization rates. Administrative costs were again identified as a major driver in the overall cost difference amongst the United States and other high-income countries.

The Data Struggle is Real

We are constantly surrounded by technology – from streaming TV, to an app that lets you see and speak to someone at your front door while you’re hundreds of miles away, to your Amazon packages being delivered by drones. There is no doubt that we are in the era of advanced technology, but adoption and investment in technology is still in its early growth stage in the healthcare industry. There could be several reasons why, including:

- A lack of general knowledge as to where to look for technology solutions

- A lack of understanding that there are solutions available to solve complex issues

- EHR implementations and maintenance is more challenging than anticipated

- All of the home-grown, legacy systems that require updating before being able to integrate with newer systems

Data interoperability is the key to these problems facing the healthcare industry. Being able to exchange, interpret, use and share data amongst other providers, payers and even the patients themselves would undoubtedly cut down on administrative waste and enhance the implementation of value-based care.

There is Hope!

These challenges are daunting, but the right partner can shed the necessary light and get your organization’s revenue cycle where it should be to maximize your revenue. Quadax is more than a revenue cycle management solution provider. We are in lockstep with our clients from the beginning and that service and commitment never ends. If you’re ready to learn how Quadax can help your organization support a growing Medicare population and a value-based care model while decreasing your administrative waste and making your data work for you, reach out any time!

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.