Read how The Ohio State University Wexner Medical Center partnered with Quadax to process claims more quickly and effectively.

Category: For Hospitals & Physician Groups

Stay informed on the latest industry news, best practices, and trends in revenue cycle management for hospitals and physician groups.

No Longer ‘Business as Usual’— Next Steps for Hospitals Post-COVID

Last week, I sat down with Professor Thomas Campanella, Director of Health Care Economics at Baldwin Wallace University, and we recorded a webinar about the steps hospitals need to take to prepare for life after COVID-19. This blog is a synopsis of that conversation. (Please note, these views are Thomas Campanella’s and are simply excerpts from the recorded webinar. For our entire discussion, please view the free webinar.)

The traditional ‘hospital’ model must be reinvented.

The largest financier of healthcare is the government (through Medicare & Medicaid), followed by employers and consumers. The unique relationship between the consumer of healthcare services and the funding provider (i.e., government, employer) has driven a true lack of competition within the healthcare market and has allowed prices to continue to soar without any emphasis placed on the true value of services. This buyer/consumer relationship is unique to the healthcare industry.

As demand in outpatient centers and homecare services continue to increase, due to escalating healthcare costs, hospitals have the most to lose because of the traditional fee-for-service model and their current reliance on the federal government bailouts as a result of COVID-19. The financial packages that are part of the Financial Recovery effort will dramatically increase the already historic highs in the national deficit.

Hospitals cannot go back to “business as usual.” They need to focus on their high fixed costs which includes infrastructure, technology and employee salaries and determine the optimal combination of these factors to allow them to be successful in the new world of healthcare.

Who’s to blame for the trouble hospitals are in?

Hospitals aren’t at fault for the situation they are facing. The fault lies with the payers who historically were not demanding value in return for their healthcare investments. This doesn’t mean consumers because they have mostly been insulated from the cost implications of their healthcare purchases. The government and employers, as the top financiers, are to blame.

Medicare and Medicaid account for approximately 50% of our healthcare costs. Medicare payment methodologies, policies and regulations influence all of the other payers that service the employer and individual markets. These policies and regulations have helped stifle competition within communities in different ways, including paying hospital-based outpatient services and procedures at least twice as much as their local competitors.

A couple of other issues that have contributed to the challenges facing hospitals are the lack of malpractice reform and the lack of interoperability between electronic medical records (EHRs). Malpractice laws in conjunction with inflationary payment methodologies incent over-utilization in the name of “defensive medicine.” The lack of “real” interoperability between EHRs not only negatively impacts cost and quality, but it is an obstacle to a more competitive environment where patients could potentially seek care from multiple providers in the community.

How can hospitals get back on solid ground?

Ideally, Medicare needs to take the lead in transitioning our healthcare system to be more value-based. The focus has been on value-based care for quite some time, but the reality is that fee-for-service is still the primary engine fueling our healthcare system. Lobbyists present a big challenge because focusing on value and bending the cost curve will negatively impact the revenue of healthcare stakeholders.

However, as a result of COVID-19, tough decisions that need to be made may now be made. Medicare has been hit especially hard by this pandemic. It is likely that we will see more of an increased focus on transitioning to Medicare Advantage Plans so the government can pass along some of the financial risk to a third-party carrier. In turn, those plans will likely have added incentives to pass along to providers to ensure their profitability, which will support the transition to more value-based care.

More employers are starting to move from fully-insured health insurance plans to self-insured as a result of escalating healthcare costs. This trend will result in employers demanding much more value in their investments and will incentivize their employees to transition into a more prudent purchaser of healthcare services.

As Tom has noted in previous webinars and blogs, the trend of declining hospital inpatient admissions and increased acuity of the patient will escalate as a result of the pandemic. Outpatient settings and care in the home will increasingly be the location where healthcare services and procedures are provided. These care settings allow for more completion as payers are increasingly searching for value and enhanced cost/quality transparency.

Mostly because of the lobbying efforts at the state and national levels, hospitals have previously avoided the disruption in healthcare by still embracing the status quo. However, COVID-19 has disrupted healthcare and the effects will be lasting. Enlightened health systems will need to embrace this new reality rather than holding on to past business models and look to collaborative relationships in different forms. It may make sense for physicians to enter into collaborative relations with independent physician groups within the community. The new reality in the healthcare industry will create competitive challenges for integrated health systems that are already burdened with high fixed costs (e.g., personnel, infrastructure, technology).

Empowering physicians to lead the necessary change.

Physicians are the brightest of the bright and they can be change agents. This may be the opportune time for hospitals to provide selective physicians more administrative roles to help lead the design of the new business models needed to be successful in this new world of healthcare.

There is a potential for the utilization of Centers of Excellence (COE) for certain inpatient services. The packaging of these services to regional and national self-insured employers and commercial payers could create both additional revenue for the hospital as well as employment opportunities. In certain communities with regionally or nationally recognized hospitals, they could be more focused on treating the high-risk patients within their communities, as a result of COVID-19.

Finally, hospitals and hospital associations must play a leadership role in working with government at all levels to ensure that we, as a society, are prepared for similar types of catastrophic events as the COVID-19, because they will occur.

Up until now, in many communities we have seen individual organizations trying to solve big health problems, like social determinants of health, in a piecemeal way. The collaboration we’re seeing today has shown that maybe it’s better to work together, and hospitals should take a lead in this arena.

Collaboration will be the key to sustainable, successful and leading healthcare systems as we move into the world of the “new normal.”

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Tools to Navigate the Medicare Revenue Cycle

With Medicare claims on the rise, and the complexity of the claims process not wavering, this guide aims to explain the ins and outs of the Medicare claims process and outline the necessary tools to make your lives easier.

The Country’s Largest Payer

In 2016, Medicare and Medicaid accounted for nearly 60% of healthcare revenues reported by the five largest U.S. commercial health insurance companies. Revenue from public coverage has more than doubled since passage of the Affordable Care Act (ACA), growing from a combined total of $92.5 billion in 2010 to $213.1 billion in 2016.

According to the Centers for Medicare and Medicaid Services (CMS), among major payers, Medicare is expected to experience the fastest spending growth (7.6 percent per year over 2019-28), largely as a result of having the highest projected enrollment growth. Medicare spending grew 6.4% to $750.2 billion in 2018.

This is why it’s so critical to not just be fluent in the Medicare claims process, but be an expert. How do you know how well you’re doing? Look at your denial rate. In 2017, the ACA Marketplace plans denied an average of nearly 1 in 5 in-network claims. While a majority of denials are recoverable, not many are appealed. It’s estimated that denial rework costs providers around $118 per claim.

The first step in avoiding denials is maximizing your first-pass, clean-claim rate.

Submitting Accurate Claims

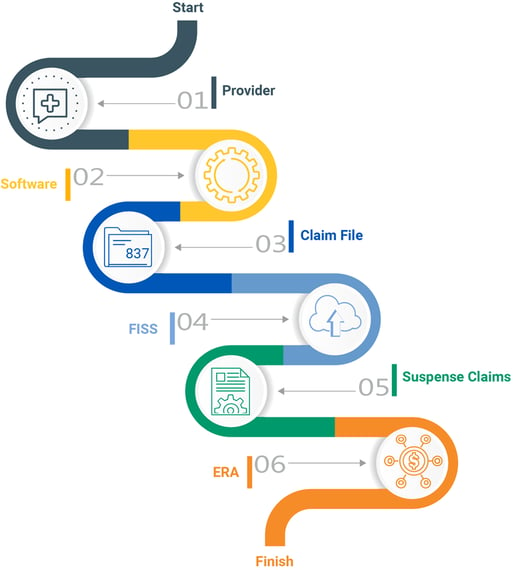

The process of submitting Medicare claims is much different than the process for commercial claims. Medicare uses their own processing system – Fiscal Intermediary Standard System / Direct Data Entry (FISS/DDE). Entering claims manually into this system is a very tedious, time consuming task and allows opportunity for human error. Most providers use a third-party clearinghouse to scrub and format claims before submitting them to Medicare. The clearinghouse receives a report of the status of claims sent to the provider.

Quadax clients use a DDE Link portal that allows users to log in, right from their familiar Quadax portal, using their own Medicare Online System ID and password to access all of the functions they need. No extra hardware is needed and access can be enabled quickly and easily.

DDE Link lives in Quadax’s best-in-class claims management system. Within the system, you can automate claim processing with comprehensive, accurate standard edits, plus edits custom to your organization, customized data conversions to overcome shortcomings in your claim generation routines, and auto-correct rules and advanced workflow to give you the greatest precision and control in your claims management. Quadax edits are constantly updated and refined, yielding a 99.6% first-pass rate, for fast reimbursement.

Errors during registration and when determining eligibility account for the majority of rejected or denied claims. Simple things like incorrect, incomplete or missing information, or the patient not being eligible on the date of service, can wreak havoc on your time and bottom line.

Quadax clients have reduced their Medicare eligibility and registration denials by more than 78% with Integrated Coverage Validation (ICV) for Medicare. Our claims management system checks HETS (the HIPAA Eligibility Transaction System) before a claim is submitted, allowing access to “insider information,” which enables you to submit cleaner claims the first time.

Here are some of the valuable insights that can be gleaned from ICV for Medicare:

- The exact beneficiary name that’s in the Medicare system, as Medicare requires for claim processing.

- Learn of frequency restrictions for 21 preventative care procedures, and the next eligible date for the patient for that service.

- Identify an HMO/Managed Care/PPO for the patient, preventing incorrect billing to Medicare.

- Determine hospice enrollment eligibility, including hospice period dates, hospice NPI, and the associated revocation codes.

- Capture SNF, hospital, and lifetime reserve day limits and uncover the days remaining.

- Determine therapy caps for occupational/physical/speech therapy, when caps are exceeded, or the cap remaining.

- Pinpoint complete liability: ICV indicates when Medicare is secondary to Working Aged Beneficiary, ESRD Beneficiary, Auto No-Fault, Worker’s Comp, PHS or Federal Agency, Disability, Black Lung, or VA Benefits.

Checking Claim Status

Medicare claims are submitted to the designated Medicare Administrative Contractor (MAC) who processes them using the FISS database. All active Medicare claims reside in FISS. Medicare assigns a status and location code to each claim. This code informs providers what is going on with the claim as it moves through the adjudication process.

If Medicare finds something wrong with the claim, it will assign the claim a new status, indicating what happens to the claim from there. Medicare can return it to the provider, reject it, deny it, or request additional development. When a provider submits a claim with administrative errors, Medicare will usually issue an RTP (Return to Provider status). These claims aren’t physically returned. They are placed in the “T” file and stay there until the provider corrects them. If a claim contains medically incorrect information, Medicare can give it an ADR (Additional Development Request), R (Rejected) or D (Denied) status. The provider can then take the appropriate action. Claims in R, P, T and D statuses can actively be worked, but only R, P and T status claims can be worked directly in FISS/DDE. Denied claims must be appealed.

Without a tool to automatically check claim status, billers must manually check FISS which provides limited visibility into claim status.

Quadax clients have access to an automated solution giving them actionable claim status information sooner using web-bot technology. This saves a lot of time in the follow up process as it eliminates the need to manually log in to FISS or call Medicare to check claim status. This tool also enables you to more accurately forecast the timing of your reimbursement.

Working Rejections & Denials

Every rejected or denied claim increases your risk of not getting reimbursed. It is estimated that more than 50% of denied claims are never reworked, because of a lack of time or knowledge.

Medicare offers specific reason codes and descriptions in FISS that gives billers detailed information about what they need to correct to process the claim. Working RTP claims in the DDE is a highly manual process requiring knowledge of DDE claims correction. Oftentimes, providers miss RTP claims and are forced to rebill them or write them off.

Providers who don’t have access to review or analyze FISS data lose an opportunity to identify inefficiencies in their billing processes that are creating unnecessary labor costs as well as avoidable claim errors.

Quadax clients have the ability to automatically create custom worklists to intelligently route Medicare denials to the appropriate staff for timely follow-up. The purpose of our Denial Management Workflow system is to provide swift, uncomplicated access to essential working documents for follow-up staff, as well as key denial inventory reporting metrics for management.

Gain insight into your data.

With Medicare paying the highest percentage of healthcare claims, understanding rejections and denials is critical when trying to maximize your reimbursement.

Comprehensive, automated Medicare reporting and analytics provide greater insight into your billing process so you can spot issues that may negatively impact your Medicare claims and follow-up efforts. In addition to analytics and reporting during claims processing, having additional services in place to manage Medicare underpayments and uncompensated care can really increase your net collections.

Decision Intelligence by Quadax helps you to gain real-time insight into complex Medicare revenue cycle data, understand data patterns and correlations, and be alerted to key events for informed decision-making. Now you can leverage actionable data for quick resolution to more effectively reach successful business outcomes – having a big impact on your bottom line.

It’s always better together!

Managing and editing rejected and RTP claims through FISS drains valuable staff time and can reduce your reimbursement potential.

The best way to protect your organization’s bottom line and avoid the chaos is to work with a thorough, experienced partner like Quadax. With deep industry expertise and technology delivered through person-to-person contact, only Quadax gives RCS professionals the freedom to consistently add value to their company. Our clients spend less time fixing problems and more time pursuing the opportunities that move their organizations forward. Going from what feels like spinning your wheels to driving excellence in your organization — that’s the real value in partnering with Quadax.

Let’s take on the revenue cycle together! To learn more, contact us at 440-777-6300 or Quadax@Quadax.com.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Protect Revenue Cycle Capabilities to Limit COVID-19 Fallout

As COVID-19 continues to spread through the country, hospitals are scrambling to overcome unprecedented clinical and patient care disruptions contrasted by new demands. More than simply making adjustments to their financial projections, hospitals need to be aware of operational issues related to COVID-19 that could negatively impact cash flow and overall performance.

Here are five Operational Considerations outlined by Healthcare Financial Resources:

1) Coding COVID-19 Claims

Coders need to be educated in the use of the new COVID-19-related CPT and HCPCS codes for both private payer and government claims. And, stemming from the National Emergency declaration, Medicare has expanded payments for professional services via telehealth, virtual check-ins, and e-visits. Failure to code COVID-19-related care correctly will likely result in denials and payment delays, which may be more difficult and time-consuming to resolve in the current environment. Here’s more information on COVID-19 coding and reporting guidelines.

How Quadax Can Help

Quadax is more than a clearinghouse. Claims Management by Quadax allows for the creation of user-defined rules, including: provider-specific edits, auto-correct or suppress edits, and custom converts. Easily stop a claim; change, leave blank or move field data; auto correct to modify data based on a particular error; or suppress an error on a claim. Our Edits and Documentation Group (EDG) is dedicated to staying on top of the latest developments for submitting COVID-19 claims.

2) Monitor Clearinghouse or EDI Capabilities

It is important that hospitals monitor clearinghouse or bank electronic data interchange (EDI) capabilities to ensure 837 and 835 files containing claims and payment information continue to transit between payers and providers. Some hospitals have reported sporadic interruptions in their EDI services. Any substantial downtime that prevents timely claims submission or denial resolution could have a significant impact on collections.

How Quadax Can Help

Quadax maintains a Corrective and Preventative Action (CAPA) document that is distributed to impacted clients when a service is disrupted. This document outlines why an issue occurred, the timeline of the issue, and what measures Quadax has taken to resolve and prevent it from happening again. Since January 2019, Quadax has only experienced a few interruptions which were fixed in a very timely manner.

3) Monitor Claim Volumes

Hospital payer mix may shift rapidly as a growing number of individuals suddenly find themselves out of work. Organizations should monitor claims frequently to determine if Medicare and Medicaid volume is increasing and/ or commercial reimbursement is falling. Significant changes could have a major impact on budget projections.

How Quadax Can Help

Decision Intelligence by Quadax can provide the tools you need to determine if your Medicare and Medicaid volume is increasing and/or commercial reimbursement is declining.

4) Automatic Claim Resolution

Payer hold times for hospital staff working denials in many instances have increased due to limited staff availability at insurance company call centers. As a result, any automation processes that allow claims to be resolved without direct payer-provider interaction should be brought to bear.

How Quadax Can Help

Our workflows quickly route claims to each biller based on client-defined criteria, and when necessary, route claims internally to maintain an accurate audit trail to reduce the need to communicate through an external environment. Workflow automation between Claims Management and EHRs/billing applications result in streamlined processes that improve clean claim rates, reduce administrative costs and provide the insight and control to recover expected reimbursement with speed and efficiency.

5) Automatic Claim Status

If they haven’t done so already, hospitals should work with payers to enable the receipt of 276/277 claim status files from clearinghouses to ensure up-to-date information regarding the status of unpaid claims. Payer portals should also be used to monitor and track unpaid claims.

How Quadax Can Help

Advanced Claim Status™ (ACS™) by Quadax automates costly, manual and unnecessary follow-up tasks related to the status of claims as they move through the adjudication process. Using client-defined business rules, the Advanced Claim Status engine will query a claim’s status by polling the payer’s web portal, using advanced screen-scraping technology to ensure the most up-to-date and actionable payer responses. Based on the responses, claims that require immediate action can be routed to the responsible party to accelerate claim follow-up. Comment records are delivered back to the EHR/billing application sooner, so staff can work smarter. We can also integrate with EHRs, including Epic.

We work hard to provide the perfect blend of sophisticated technology with reliable, expert, personal support. Let’s take on the revenue cycle together!

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

How to Receive Reimbursement for Uninsured COVID-19 Patients

Two pieces of legislation were passed that will provide reimbursement for testing and treatment of uninsured COVID-19 patients. Families First Coronavirus Response Act or FFCRA and the Paycheck Protection Program and Health Care Enhancement Act which each appropriate $1 billion to reimburse providers for conducting COVID-19 testing for the uninsured.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act provides $100 billion in relief funds for hospitals and other health care providers on the front lines of the COVID-19 response. Within the Provider Relief Fund, a portion of the funding will be used to support healthcare-related expenses attributable to the treatment of uninsured individuals with COVID-19.

The projected implications

Researchers from the Kaiser Family Foundation estimated total hospital reimbursement to range from $13.9 billion to $41.8 billion depending on the rate of and severity of COVID-19 hospitalizations among the uninsured population.

Researchers also estimated that up to 2 million uninsured individuals could require hospitalization for COVID-19. Although, that number could be as low as 670,000 hospitalizations.

Total hospital reimbursement for the treatment of uninsured COVID-19 patients would come from the billions in dollars in emergency spending for hospitals included in the coronavirus stimulus package.

How to participate in the COVID-19 Uninsured Program

Health care providers who have conducted COVID-19 testing or provided treatment for uninsured individuals with a COVID-19 diagnosis on or after February 4, 2020, can electronically request claims reimbursement through the program and will be reimbursed generally at Medicare rates, subject to available funding. Steps will involve: enrolling as a provider participant, checking patient eligibility, submitting patient information, submitting claims electronically, and receiving payment via direct deposit.

Beginning on May 6, 2020, providers can start submitting patient information and claims for reimbursement through this Health Resources & Services Administration portal. The following information is required when signing up for the program.

Provider Information:

- Taxpayer Identification Number (TIN) Validation, which can take 1-2 business days to process.

- Optum Pay Direct Deposit/ACH, which can take 7-10 business days to process.

- Provider Roster, which can take 1-3 business days to process.

Patient Information:

- Uninsured Individual Information: patient information needs to be submitted individually or through a batch upload.

- Attestation: Provider must attest that the patient does not qualify for any healthcare including Medicare or Medicaid.

- Temporary Member ID: This is needed before a claim can be submitted. It takes less than 24 hours to be received and is valid for 30 days.

Claim Information:

- For dates of service or admittance on or after February 4, 2020, providers will be eligible to seek reimbursement for COVID-19 testing and testing-related visits for uninsured individuals, as well as treatment for uninsured individuals with a COVID-19 diagnosis.

- Claims must be submitted electronically through a clearinghouse. No paper claims will be accepted.

The HRSA COVID-19 Uninsured Program is using a unique version of Smart Edits (i.e., edits created by the HRSA payer), which is an EDI capability that detects electronic claims with potential errors. When a claim is submitted with a potential error, Smart Edits sends a message back to the submitting care provider to explain why the claim was rejected and provides direction on how to resolve as part of the X12 277CA claim level response. Repaired claims should be sent with the original frequency code of 1, not with a replacement or voided claim indicator of 7 or 8.

The submitting care provider is responsible for working their 277CA and resolving rejections as applicable to avoid denials. The HRSA has established this process to help our clients catch claim billing errors and correct them because all claims submitted will be complete and final. Interim bills, corrected claims, late charges, voided claim transactions and appeals will not be accepted.

Quadax is more than a clearinghouse. Claims Management by Quadax allows for the creation of user-defined rules, including: provider-specific edits, auto-correct or suppress edits and custom converts. Easily stop a claim, change, leave blank or move field data, auto correct to modify data based on a particular error, or suppress an error on a claim. Our Edits and Documentation (EDG) team is dedicated to staying on top of the latest developments for submitting COVID-19 claims.

Payer Information:

- Claims should be submitted through your clearinghouse using the Payer ID 95964 (Payer Name: COVID19 HRSA Uninsured Testing and Treatment Fund) using claim type NACO12, NACO34, or NACO64.

- Clearinghouses will receive a 999 file level acknowledgement and 277CA claim level report to include HIPAA and ACE rejections which will be passed to the provider. 835s will not be delivered via the clearinghouse connectivity; providers will be required to access via OptumPay. EOBs will not be issued to patients.

Reimbursement Information:

- Reimbursement will be based on current year Medicare fee schedule rates (except where otherwise noted) and on the incurred date of service.

- Publication of new codes and updates to existing codes will be made in accordance with CMS. And, for any new codes where a CMS published rate does not exist, claims will be held until CMS publishes corresponding reimbursement information.

For more information about eligibility, what’s covered, important dates and to sign up for the program, visit https://coviduninsuredclaim.linkhealth.com/.

We hope you stay healthy and well.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Telemedicine: Adoption Rates, Barriers to Adoption, and The Future

Telemedicine has been a hot topic in the healthcare industry for a decade now. Every year, analysts have predicted telemedicine would become more of a priority for healthcare providers. However, adoption rates remained low until the outbreak of COVID-19 forced healthcare providers to embrace telemedicine to recoup drastically declining revenue.

Recent adoption on the provider side

According to the American Medical Association (AMA), only 28% of doctors reported using telemedicine in 2019, which was about double the figure for 2016.

But now, as the result of a global pandemic, telemedicine startups in the United States (i.e., Amwell, Doctor on Demand, Ro, and 98point6) have reported an unprecedented surge in use as patients are told to avoid going directly to the ER if they do not have severe symptoms.

According to a March 2020 SSCG Media Group study, 53% of the healthcare practitioners surveyed said they were using telemedicine because of the restrictions imposed by COVID-19, but they had not used telemedicine prior to this pandemic.

Recent adoption on the consumer side

On the consumer side, a November 2019 Cheddar survey conducted by YouGov found that only 12% of United States adults had used a telemedicine app, and roughly the same (14%) said they had never heard of telemedicine apps or websites. But nearly two-thirds were at least somewhat comfortable with the idea of receiving medical consultation over the phone or internet, citing convenience (53%) and cost (44%) as reasons to do so.

A McKinsey & Company study fielded in mid-March this year found that one in three respondents canceled upcoming medical appointments due to COVID-19. Roughly the same percentage (30%) said they would be interested in providers that offer online/video visits with a physician.

Between February and March 2020, the number of US adults who reported the desire to use telemedicine rose from 18% to 30%, per CivicScience data. In February, about one in 10 said they had tried telemedicine, growing to 17% in March.

Previous barriers to telemedicine

“There were three barriers that impacted the lack of adoption, or the slowness of adoption, before the pandemic hit. We saw cost … availability … and then we also saw relationships playing a factor,” said Forrester analyst Arielle Trzcinski.

Those barriers were immediately knocked down once a national emergency was declared, due to COVID-19, and people were discouraged from leaving their homes for non-essential reasons.

The cost barrier was also broken down when the Centers for Medicare and Medicaid announced that they would pay the same rates for virtual visits as for in-office appointments. Regulations allowing the use of mobile devices for virtual visits were also temporarily lifted.

So, will it continue?

Telemedicine should continue to be used long after the COVID-19 pandemic is over for many reasons, but most importantly, to limit the number of sick people in a hospital setting to avoid spreading illnesses. In Ohio, 20% of positive COVID-19 cases were healthcare workers. We need our healthcare workers to stay healthy, so defaulting first to a virtual visit will help that effort.

Second, the cost of treating people virtually is much less than caring for them in a hospital setting. According to medical news site STAT, UnitedHealthcare estimates that a telemedicine session costs less than $50. That’s a much more affordable alternative to a possibly unnecessary visit to the emergency room—which could cost more than $2,000.

That being said, the main reason telehealth has skyrocketed is because of the relaxed CMS regulations. “We’ll likely need a legislative change for these changes (the reliance on telemedicine) to be permanent,” said Carrie Nixon of Virginia-based Nixon Law Group, who has been following the telemedicine space for years. “There will be more of an impetus now. Once patients have had telehealth, it’s likely they won’t want to go back.”

How does Quadax fit in with this trend?

Many of our clients have launched telemedicine over the last couple of months. We are helping them understand eligibility much faster. They are getting a response in seconds rather than waiting on hold for 13 minutes to confirm a patient’s eligibility.

In addition, XpressBiller, our powerful claims rules and edit engine, is designed to allow clients to build custom converts and edits they are unable to make in their HIS system to help detect, assign, correct, and minimize errors in real-time before the claim is released to the payer. It can easily add modifiers for telemedicine before submitting your claims.

We can also provide you the tools you need to analyze all of your data to determine what is causing denials and what needs to be addressed to maximize your net collections.

We’re all in this together. Stay healthy and well.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

The Road to Recovery – Resuming Elective Surgeries

After over a month of not performing elective surgeries, healthcare providers are losing a significant amount of revenue. The pause on elective surgeries was meant to flatten the curve of COVID-19 and allow hospitals to prepare for a major influx of infected patients.

An anesthesiologist from Stanford cited that 41% of Wuhan cases were likely acquired from hospitals, which is reason enough to reduce the number of people coming into healthcare facilities.

The dramatic impact on revenue

As a result of stopping elective surgeries, the healthcare industry seems on the brink of disaster. Plummeting revenue, compounded by higher costs for supplies like personal protective equipment, has led health care executives to take drastic steps like cutting payroll to try to keep their lights on as they fight the pandemic.

The Department of Labor’s March jobs report showed a loss of nearly 43,000 health positions, the sector’s worst month in at least three decades. And those numbers are from mid-March, before most closures and stay-at-home orders took effect.

According to a Medical Group Management Association survey, nearly half of medical practices have temporarily furloughed staff, while another 22 percent have permanently laid off employees — a situation that is expected to get even worse in the next month.

The road to recovery – resuming elective surgeries

On Sunday, April 19, The Centers for Medicare & Medicaid Services issued their initial set of guidelines for re-opening facilities for elective procedures. Jointly, the American College of Surgeons, American Society of Anesthesiologists, Association of periOperative Registered Nurses, and American Hospital Association put out a joint recommended roadmap for resuming elective surgeries after COVID-19 on April 17.

The guidelines provided a phased-in approach to restarting elective procedures. Included in the guidelines is the ability to regularly screen for COVID-19 amongst patients and care providers.

Fifteen states have already announced plans to begin the phased approach by the end of May. These 15 states account for roughly 30% of the total United States population. The remaining states are still evaluating the guidelines and applying them to their current plans of restarting elective procedures in their states.

Amongst some of the elective surgeries being evaluated to restart are for non-emergent, yet time-sensitive procedures, like cancer surgeries and biopsies. These procedures will drive molecular lab volumes to increase as they are phased in over the coming months.

How can we help?

Our ability to provide visibility into states, facilities, and providers ordering tests will allow for a targeted approach as America overcomes this crisis. Our advanced software will assist your company in maximizing reimbursement and track near real time how insurance companies are processing claims. Additional analytics can provide advanced forecasting of revenue month to month. Quadax is your partner. We are IN THIS TOGETHER.

Stay healthy and well.

Life After Coronavirus – How Will Hospitals and Physician Practices Be Impacted?

We recently sat down with Professor Thomas Campanella to ask him questions about what’s next in the complex world of healthcare – after the coronavirus has subsided. We hope you find his insights valuable.

An Interview with Professor Thomas Campanella

Director of Healthcare Business Programs, Baldwin Wallace University

Question 1:

Our healthcare system in America is facing tremendous disruptions. Can you describe the impact on hospitals and health systems as a result of COVID-19?

Answer:

First of all, I would like to thank all of the healthcare workforce who have been on the front lines protecting both their patients and the community. Society owes them a debt of gratitude.

This pandemic is going to impact hospitals differently depending on their size. A large hospital system that had a reasonably good bottom line going into this is going to weather the storm much better than a system that not only has lower profit margins but also lacks financial reserves.

The financial impact could be catastrophic for some hospitals, especially smaller, rural and independent hospitals. I am especially concerned about rural hospitals, which were already facing many financial challenges. These hospitals need to receive immediate assistance from the federal government.

Question 2:

Could you identify some of the specific financial challenges hospitals are facing?

Answer:

Most hospitals just break even on much of their operations and services. Surgeries, including elective procedures, are how they generate the most revenue. The loss of that constant revenue is having a big impact on cash flow.

Many of my contacts within healthcare predict a significant amount of that volume will never be recaptured. They’re estimating that 75 percent of patients who put off elective procedures will ultimately have surgery once the pandemic passes, but 25 percent will forego surgery entirely. There could be many reasons for that. Some may be fearful of infection following the pandemic. Others may pursue less invasive therapies as an alternative to surgery.

Not only is there a reduction in revenue to contend with, there are increased expenses. The biggest concern for hospitals from a cost standpoint is labor. They’re needing to hire more staff—not just nurses, but respiratory therapists, infection control professionals and even housekeeping staff. I’m getting indications that pay could be quadrupled for these employees during this time period. They’ve had to increase compensation, almost like hazard pay. In addition, part-time nurses are becoming full-time and full-time nurses are working overtime.

Question 3:

Can you describe the impact on independent physician practices as a result of COVID-19?

Answer:

Independent physician practices are very vulnerable as a result of COVID-19, especially primary care practices which have historically low profit margins. These practices mostly rely on fee-for-service payments and many estimate they are 2-6 weeks away from running out of cash as they are already scaling back on hours and staff. To their credit, CMS has moved quickly and has shifted Medicare FFS practices to a prospective payment model.

It is now time for health insurance companies, self-insured employers (especially large employers), and local government to step up. Both health insurance companies and employers recognize the short- and long-term value of supporting a strong independent physician presence in their community. These payers need to find creative ways including immediately implementing some form of prospective payments as well as Periodic Interim Payments (PIP), to give these independent practices a cash-flow lifeline.

Question 4:

What can or should physician practices be doing to ensure they are best positioned for business when we get the all-clear from this pandemic?

Answer:

Independent physician practices need to embrace and invest in telemedicine capabilities. Physicians should not look at telemedicine as competition, but as an opportunity to provide better value to their patients and increase their geographic market. It is also a great insurance policy during times like this.

Physician practices must also look to finding ways to become more efficient as well as provide better value to their patients. This focus on efficiencies and value could result in more collaborations with third parties (telemedicine, their backroom (billing, etc.), other community providers, payers and hospitals, etc.).

Independent physician practices may also want to look to establishing collaborative relations with physician practices within their own state or the country that are in their same specialty.

Finally, there are a number of for-profit physician organizations nationally that may be open to creative ways to establish a relationship that would be beneficial to all parties.

Question 5:

What can or should hospitals, health systems be doing to ensure they are best positioned for business when we get the all-clear from this pandemic?

Answer:

Just like independent physician practices, hospitals and hospital systems need to embrace and invest in telemedicine capabilities.

Hospitals also need to aggressively focus on finding ways to increase efficiencies. Ultimately, they need to reduce costs and knock down the silos within the walls of the hospitals that have contributed to their historical operating inefficiencies.

Hospitals also need to more aggressively explore opportunities to outsource and collaborate in different ways (backroom, supply network, other providers, health insurance companies, etc.).

Question 6:

Our economy has been impacted dramatically and unemployment claims are soaring, employers are hard-hit with many possibly not able to recover, and government at all levels is experiencing unheard of financial challenges. What does all of this mean to our healthcare system?

Answer:

Our healthcare system is financed by the government (Medicare/Medicaid), employers and consumers. All of these stakeholders will be financially hurting as a result of the impact of the Coronavirus. Our federal government was already at historic highs in the national deficit. The Financial Packages that are part of the Financial Recovery effort will dramatically increase those deficits.

While hospitals will be looking for ways to enhance revenue, including financial assistance from the government, they also need to place much of their focus on reducing costs and reinventing their business model.

Hospitals will need to specifically focus on their high fixed costs which includes infrastructure, technology, and sadly, employee salaries. Hospitals will need to determine the optimal combination of infrastructure, technology, and staff to allow them to be successful in this new world of healthcare.

Inpatient admissions, long-term, will continue to decrease while the acuity level of the patient increases. Inpatient hospitals could function more like a giant ICU center.

Hospitals need to explore closing of unprofitable services and expansion of profitable services.

Hospitals will also need to find ways to be more competitive in the outpatient and home care markets. Given their financial challenges, payers (government, employers, consumers, etc.) will be demanding increased transparency (cost/quality). This will be especially difficult for hospitals and hospital systems, since their higher fixed costs will create challenges in competing against local, regional and national organizations in the fast growing outpatient and care in the home-setting arena.

As noted previously, the effective utilization of telemedicine is an example of one way a hospital could be more competitive in the outpatient and home settings. We are starting to see an acceptance of telemedicine across all generations.

Question 7:

How will these changes impact hospital employees and the local community?

Answer:

Reconfiguring the hospital inpatient setting to focus on fewer, but more higher acuity patients, will impact staffing (clinical and non-clinical), technology utilized, and less overall inpatient infrastructure.

Since there will be less focus on “routine care” in the inpatient setting, some staffing could be moved to the outpatient or home setting.

Healthcare is local, but “Life after Coronavirus” could also result in a potential reduction in clinical and non-clinical staff including, depending on their specialty, employed physicians which are part of the hospital’s fixed costs. Some of these physicians could transition to the community either with existing practices or new practices. Physicians could also establish a relationship with regional or national for-profit/non-profit organizations as well as payers (self-insured employers, commercial insurance companies, etc.).

In communities where this occurs, it would make sense for the hospitals to attempt to establish collaborative relationships with the above stakeholders.

There will also be more outsourcing and collaborations in different forms including with their supply chain which could result in clinical and non-clinical employees working for a third party that has a relationship with the hospital.

Again, depending on the hospital and the locale, hospitals/hospital systems could also leverage their investment in personnel and technology in the inpatient setting providing services to patients with higher acuity levels. There is a potential for the utilization of Centers of Excellence (COE) for certain inpatient services. The packaging of these services to regional and national self-insured employers and commercial payers could create both additional revenue for the hospital as well as employment opportunities.

In certain communities, regionally or nationally recognized hospitals already exist. “Life after Coronavirus” could result in these hospitals becoming even more focused on treating the high-risk patient both within their community, as well as regionally and nationally.

Finally, if certain hospital services are grossly unprofitable, it will also create an opportunity for hospitals in the community to collaborate together along with local governmental and non-profit entities to provide more cost-effective accessible care.

Question 8:

Wait. You are saying the hospital inpatient admissions and in-turn the hospital inpatient infrastructure will be decreasing even at a faster pace after Coronavirus? Shouldn’t it be increasing, especially, if and when something like this happens again?

Answer:

We need to compartmentalize what is occurring. We need to focus separately on the “Coronavirus time period” vs. “Life after Coronavirus.”

There are obviously immediate financial, staffing and care concerns occurring as a result of the Coronavirus, and they need to be addressed. But the hospital will also have quite a different life once we get through this pandemic.

As noted previously, there will be increased pressure from payers as well as consumers to limit utilization of services in the hospital inpatient setting (because of costs, risk of infection, etc.). Correct or not, there will be an enhanced perception that “sick people are in the hospital” and there will be increased demand for care to be provided in the outpatient and home settings.

Consequently, we also cannot afford to have hospital inpatient facilities operating with excess capacity. It would be too costly.

Question 9:

But, what if another pandemic occurs? We will be back searching for enhanced inpatient capabilities (staffing, infrastructure, supplies, etc.).

Answer:

You are correct, we have to assume that something like this pandemic will happen in the future. The question is when, not if.

We must be prepared with the ability to expand capacity, staffing, and supplies during emergency situations similar to Coronavirus. We must identify innovative approaches up-front which would allow us to adapt to such a crisis in a minimal time frame.

How? I do not have the exact answer. This is where we need to convene experts on the national, state and community level.

Ideas have already surfaced including regional publicly run hospitals that only focus on infection diseases; the conversion of Convention Centers, government buildings, etc. to hospitals; ability to adapt space in the hospital setting to accommodate crisis situations, etc. Other?

Question 10:

In general, healthcare is a very competitive industry. In the midst of the crisis, there’s a spirit of collegiality among physicians, nurses, hospitals, and health systems. Do you think competition could give way to new cooperation in healthcare? How could that benefit patients?

Answer:

There has been unprecedented collaboration and teamwork among community providers as well as with business, government, health insurance, and non-profit sectors.

This collaboration should, and needs to, continue.

We need to continue our focus on population health and addressing the social determinants of health which will require collaboration between all of the above stakeholders. Population health and addressing the social determinants of health by its very nature requires collaboration. Sadly, we have seen first-hand how the lack of sustained focus on social determinants of health has translated to an increased percentage of death as a result of COVID-19 among the less-advantaged in our communities.

Up to now, in many communities we have seen individual organizations trying to solve these big health problems in a piecemeal way. I think the collaboration we’re seeing today has shown that maybe it’s better to work together.

We cannot go back to business as usual. We still need to focus on evolving our “sick-care” system to a real “health” system.

From a revenue perspective, there can and will be more potential collaborations with the payer side (insurers, employers, etc.) such as joint ventures, revenue sharing tied to risk, etc.

Quadax 11:

Will “Life after Coronavirus” have less of a focus on risk/value-based reimbursement?

Answer:

We still need to embrace a risk/value-based payment system, which during the short-term will be challenging for health systems that utilize the “fee-for-service” (the more you do the more you make) as their lifeline.

Hospital-based Accountable Care Organizations (ACOs) need to embrace downside risk. I know that ACOs are asking for relief from downside risk, but the only way we can truly knock down the silos within and outside the walls of the hospitals is with appropriate incentives. Downside risk, while initially painful, will force efficiencies and collaborations that would not have occurred otherwise. These efficiencies and collaborations will allow both the hospital and the ACO to obtain long-term success.

All of this does not mean that in the short-run there could be somewhat of an easing on the risk-side for reimbursement arrangements. But, it needs to be just in the short-run, since it is critical that we ultimately embrace the risk/value-based approach to a better and more efficient health system.

Independent physician groups that have entered into risk arrangements with payers should specifically be looked at for potential easing or eliminating of the risk component in the short-term. Independent physician groups have had a solid track record in managing care for Medicare-Risk payers but, given their relatively low financial reserves, they could be in a financially precarious position.

Question 12:

Do you have other thoughts or perspectives on the short and long-term impact of the Coronavirus on our healthcare system as well as the continued disruption that is occurring in the healthcare marketplace? What can government and other stakeholders do to help ensure we will have a strong and viable healthcare system?

Answer:

While there will definitely be short- and some long-term negative impact from this experience, I believe in the long run we will survive with a stronger healthcare system.

While hospitals may not like this example, the auto industry in the 1980s was impacted by its own crisis and, while there was a lot of pain during the transition, they emerged as a much stronger industry which ultimately provided much better value to the consumers. A key element to the auto industry success was especially strategic collaborations with their supplier network while focusing on becoming a more cost-effective and quality operation.

Hopefully, this current crisis will also be a wake up call that allows us to more aggressively focus on increasing the number of physicians and other clinicians, especially in the primary care arena, as we enhance our focus on population health. There should be serious thought to forgiving medical school loans, etc. for physicians who go into primary care.

The healthcare sector, especially hospitals and pharma/biotech, are in many areas unnecessarily regulated, resulting in increases in healthcare costs while stifling innovation and slowing the introduction of new life-saving medicines. Hopefully, the efficiencies gained by some of the relaxation of regulatory roadblocks will be thoughtfully considered prior to going back to the “old ways.”

We also need to increase focus on national and state malpractice laws which result in greater utilization of defensive medicine. The necessity of addressing these malpractice laws will increase as we continue to evolve to payment methodologies based on risk/value.

It is also important for states to seriously evaluate the expansion of Medicaid eligibility to their population. Medicaid Managed Care organizations have proven to be a good partner for states in providing not only enhanced costs efficiencies, but also optimizing access and quality outcomes for the participants.

Finally, we need to reevaluate the focus of the Community Benefit Formula for non-profit 501-C3 corporations. Hospitals receive tax exemption as part on their non-profit status and in return they provide “Community Benefit.”

If we want to truly evolve to a health system vs. a “sick-care system,” we need to redirect the focus of the Community Benefit to outside of the walls of the hospital. Currently most hospitals justify their Community Benefit by focusing on financial shortfalls relating to providing services to Medicaid members and Medical Education. The focus of much of this justification are within the walls of the hospital and tied to services “after” a person is already sick, etc.

The area that has less of a focus falls under the umbrella of population health initiatives. By focusing the Community Benefit to population health initiatives within the “community” it will also create incentives for hospitals to collaborate with each other as well as with community stakeholders.

Question 13:

Do you have any concluding comments?

Answer:

I understand that what I am saying will not be welcomed by all hospitals, but it is a reality. I want hospitals to thrive and prosper, but there is a stark reality that what was present prior to the Coronavirus onslaught was that we as a society could not afford the escalating costs of healthcare, and that reality has not changed.

The good news is that hopefully we, as a nation, can use this experience to truly transition our “sick care” system to a “health system” that focuses on overall population health. Hospitals can play a leadership role in this transition on a national and community level.

Hospitals and hospital associations must play a leadership role in working with government at all levels to ensure that we, as a society, are prepared for similar types of catastrophic events as the Coronavirus, because they will occur.

Finally, as I have noted in previous blogs and podcasts, during times of disruption those individuals that make a difference in the success of an organization will be rewarded ten-fold. This is especially true for the doctors and nurses who have shown such great leadership skills and bravery during this crisis.

Thomas Campanella is the Director of the Health Care MBA program and a professor of health economics for Baldwin Wallace University in Cleveland, Ohio. He also writes a healthcare blog on LinkedIn, follow him here.

4 Things to Consider When Billing Coronavirus Patients

The healthcare industry has been thrown a curveball with the introduction of the Coronavirus Disease 2019 (COVID-19). Becoming one of the biggest threats to the global economy and financial markets, the monetary impact remains unknown – both on the provider and patient side. HFMA Policy Director, Chad Mulvany, spoke out to provide guidance on the four things health systems should be doing now to keep coronavirus patients satisfied with their experience after they return home.

Get familiar with payer policy exceptions for coronavirus.

America’s Health Insurance Plans has compiled a list of what some health plans are doing. Many are waiving copays for testing and covering telehealth services. Furthermore, the IRS has said that high-deductible health plans (HDHPs) can pay for testing and treatment without losing their HDHP status. Knowing what payers are doing will make for a more seamless billing experience for the patient, Mulvany said.

Rethink the organization’s financial assistance policies.

Many patients are losing work due to closures and restrictions resulting from the coronavirus and won’t be able to pay a bill that may not have been a problem a few months ago. It might make sense to extend assistance to people who wouldn’t otherwise qualify, Mulvany said. “I don’t know if it’s reasonable to do, but it’s a conversation to have,” he said.

Screen patients for financial assistance.

Be sure to communicate all applicable policies and practices for medical account debt resolution and provide financial assistance and/or charity options, if applicable.

Stay current with coronavirus coverage.

The Centers for Disease Control and Prevention has a wealth of information and resources on their website that is updated frequently.

With the uncertainty the coronavirus brings, Quadax understands researching new revenue cycle management solutions or vendors is most likely not a high priority on your list. But, please know, we are committed to serving and helping our clients’ billing processes. We hope you all stay happy and healthy!

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.